"At a Glance" publication - cross-border investment in Europe. Foreign investment dropped 19% in 2016, after a record volume in 2015.

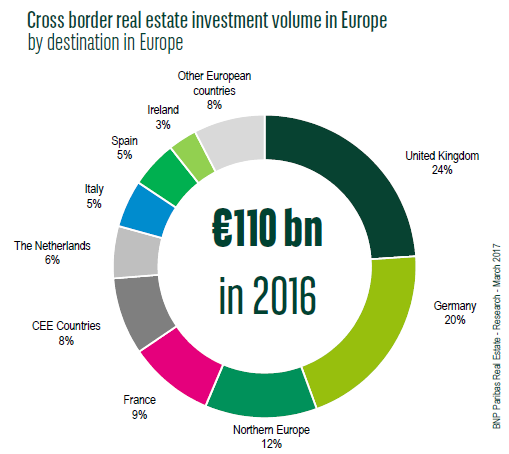

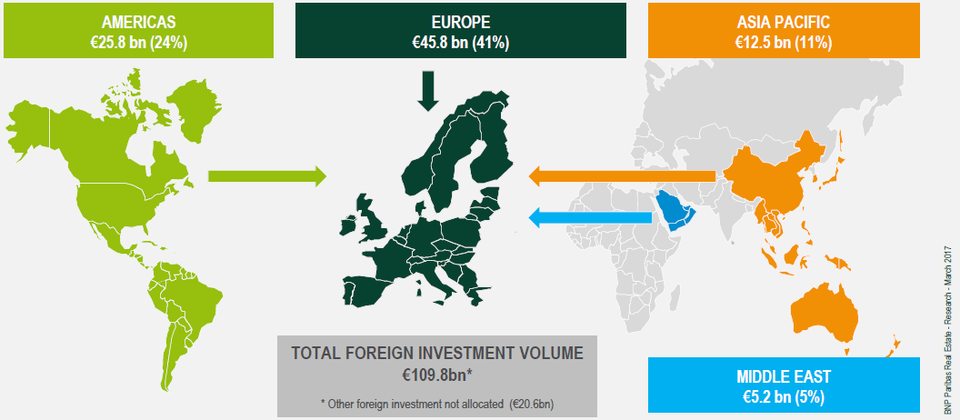

One of the strengths of the European commercial real estate market has been the amount of capital moving in between markets and flowing into Europe. After peaking in 2015, the share of cross-border investment dropped to 48% of the total in 2016 but, at €110 bn, it is still the third highest amount in the last ten years.

Etienne Prongue, head of International Investment Group at BNP Paribas Real Estate

Besides drops in volume, there was no change in the relative ranking of the destinations of foreign capital. Indeed, the UK remains #1 destination of foreign investment in Europe, but dropped 30% in volume due to the wait-and-see attitude of most investors. Germany suffered from an on-going shortage of supply which has held total turnover back; international investment volume was 20% down on 2015. Whereas, France, albeit dropping 19% of foreign investment, still represent 9% of their European allocations. The main gainers were Ireland, The Netherlands and Central & Eastern Europe.

Céline Cotasson-Fauvet head of Pan-European Research at BNP Paribas Real Estate